My Honest Review of The Master Your Money Super Bundle 2020

Note: Affiliate links may be used in this post. I may receive a small commission at no extra cost to you if you use my affiliate link. Full disclosure policy here

Master Your Money Super Bundle 2020

Are you interested in purchasing the Master Your Money Super Bundle 2020? I purchased this bundle from Ultimate Bundles and spent several hours going through all of the resources available in this package. This post is my honest review of the Master Your Money Super Bundle. I’ll discuss what I really liked about the package and some things I think could have been done better.

The Master Your Money Super Bundle has been a popular addition in the past and is only being offered for the next 5 days through Ultimate Bundles. If you’re curious about this bundle and are wondering if it’s worth buying, keep reading for my full review of this package.

My Honest Review of the Master Your Money Super Bundle

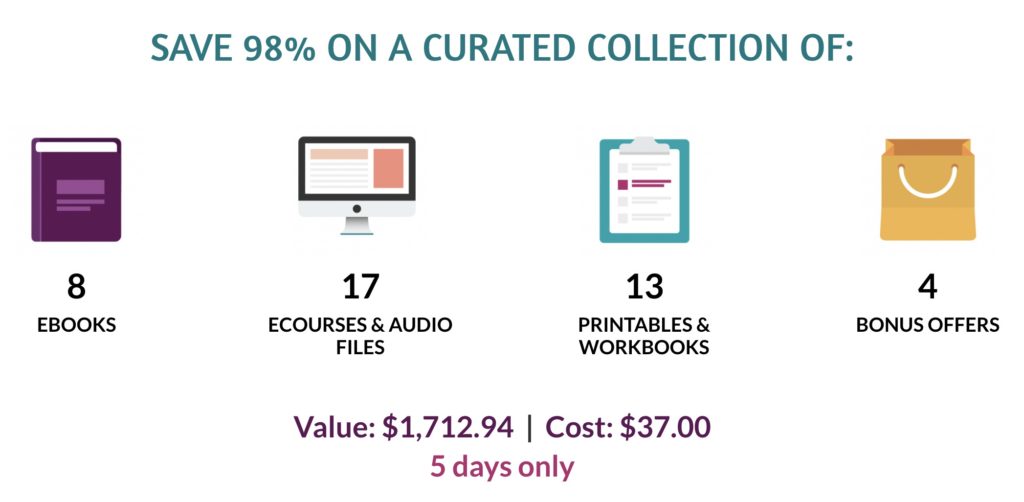

So I purchased the Master Your Money Super Bundle because I am always looking for new and fresh ideas on how to manage my family’s personal finances. Once I purchased the bundle I spent several hours just pouring over all of the coursework in this bundle. There are 8 e-books, 17 e-courses and audio, 13 printables and worksheets, and 4 bonus offers. Again, there is a lot of information contained in the package, and if you choose to purchase one should expect to spend a lot of time going through and reading.

Overall, my initial opinion of the course is positive. It contains a fair amount of information geared towards budgets, planning, mindsets, side hustles, and how to pay off debt. However, it is not without its downsides also, which I’ll detail throughout this review.

Negatives of the Master Your Money Super Bundle

- So one of the things that I noticed right away after downloading this bundle was that it didn’t really have a detailed roadmap of what you should start with. You can download the entire bundle with all of the resources and e-books and sign up for all of the e-courses online. Once you’re done with that you need to go through and decide which course to do first or which ones to do first which can be a bit overwhelming.

- Speaking of overwhelming…there are a lot of courses available in this super bundle. Like, a lot! One will need to set aside time periodically in order to devote to working through all of the courses and resources. Some folks don’t have very much spare time to spend on courses and a bundle jam-packed with information is going to take time to digest.

- Some of the coursework within the Master Your Money Super Bundle had an overlap of information. I did notice a few times while going through different courses that there was some overlapping methods or information. For instance, there are a few courses that detail how to set S.M.A.R.T. goals and a couple of the courses that discuss the debt snowball. In most cases, I can understand why there would be overlap as this bundle is a collection of courses from different content creators. I can also partly see this as positive as I am able to see how different authors would teach these subjects.

Now we can discuss what this super bundle got right and what I thought of the rest of the package.

What I Loved About The Managing Your Money Super Bundle

- There is a lot of informative instruction on managing your money and making more money and income. I know I called this out earlier as a potential downside, but someone with little to no knowledge of personal finance would find this package very helpful. It covers a wide spectrum of topics in personal finance that are essential for effectively managing your money, such as budgeting and paying off the unpaid debt.

- I’ve found that the included resources are very helpful in planning and documenting your personal information. Some of the courses come with very nice printables that help walk you through the coursework and to work on your financial numbers. You’re even given a cool debt Excel spreadsheet to work on coming up with a budget and for paying off debt.

- I found the supplied cheat sheets that you can add to the bundle to be super helpful for summarizing key points of each of the courses. They are even helpful if you look at the cheat sheets first to go through the summary so you can better learn what the main points of each course are and to help you decide which courses you should work through first. They can help you save a ton of time.

- I also really liked that Ultimate Bundles gives you a 100% 30-day money-back guarantee.

- I also feel that the $37 price tag is hard to beat considering the sheer amount of coursework and information you are given in this bundle. Even if you only use one or two of these courses, it would be hard to purchase just one of them for $37. Knowing this, I would definitely recommend others wanting to improve their financial knowledge and position to grab this bundle while it’s still available.

My Favorite Resources In The Managing Your Money Super Bundle

Destination Financial Freedom – Budgeting Binder: In the budgeting section I found the budget binder to be fantastic. It is a 40-page e-book that is very well laid out with clear instructions on how to work through the course. I really liked that the pdf is editable and can be filled in on the computer without needing to be printed out first. I found the printables in the workbook to be eye-pleasing and helpful. Here are the highlights in the budget binder

Destination Financial Freedom – Budgeting Binder: In the budgeting section I found the budget binder to be fantastic. It is a 40-page e-book that is very well laid out with clear instructions on how to work through the course. I really liked that the pdf is editable and can be filled in on the computer without needing to be printed out first. I found the printables in the workbook to be eye-pleasing and helpful. Here are the highlights in the budget binder

- Past spending tracker

- Creating S.M.A.R.T Goals

- Paycheck Budget

- Creating an Emergency Budget

- Daily Expenses Tracker

- Creating Savings Buckets

- Using the Debt Snowball

- Destination Debt Payoff

- Destination Savings

- Roth IRA and Investment Tracker

- and much more

Cash Envelope System: This was another resource I found to be very helpful in that it provides you with printable envelope designs by expense type. The printables are colorful and easy to distinguish between other expenses. Here is a list of the envelope types and resources included.

Cash Envelope System: This was another resource I found to be very helpful in that it provides you with printable envelope designs by expense type. The printables are colorful and easy to distinguish between other expenses. Here is a list of the envelope types and resources included.

• Food

• Clothes

• Vehicles

• Medical

• Hair cuts

• Pet care – cats

• Pet care – dogs

• Eat out

• entertainment

• fun

• gifts

• Garage sales

• Transaction register

Destroy Your Debt Spreadsheet: This spreadsheet is a great resource for tracking and paying off your debt. It has a total debt spreadsheet, Mortgage sheet, Student loan debt sheet, credit card sheet, auto loan sheet, medical and personal debt sheets. I am using this spreadsheet as a resource with the Budget Binder course to help keep track of our expenses. I have found it to be very helpful.

Side Business Starter Kit: The side business starter kit is another course I found to be very helpful. It gives a straightforward easy to follow framework to help you identify what side business you should start based on your unique talents or skills and gives you over 20 examples of side businesses that you can start. It also helps you organize and brainstorm your business plan and planning how to start your business. What was helpful for me was the section on fitting your side business into your existing schedule. Sometimes it is difficult to carve out enough time necessary to work on a side business. The side business starter kit gives you many examples and exercises for time management and how to work it into your schedule. This course was one of my favorites.

Who Do I Believe The Managing Your Money Super Bundle Is Right For?

My overall opinion of the Managing Your Money Super Bundle is that it contains a large number of financial resources that I feel are beneficial for those that are interested in improving their personal finance knowledge. It provides a high value of information for a relatively low price.

Who Benefits Most From The Information In This Bundle?

- Those folks that have financial debt and are needing a simple straightforward method for paying off that debt.

- You are tired of working at your existing job and are looking for a way to start your own side hustle or business.

- You are new to budgets personal finance and are wanting to get a handle on your finances.

- You are interested in learning about time management, planning for your financial future, and for increasing your lifetime income.

Who Do I Believe This Product Is Not Good For?

- If you are already very familiar with personal finance, paying off personal debt, and creating a high income through your own business, I feel that you wouldn’t find a lot of new information here. You would probably be better served to look elsewhere in order to take your knowledge to the next level.

Are You Ready To Purchase?

Click here to order your copy of The Managing Your Money Super Bundle for only $37.

P.S. Please feel free to message me with any questions you have regarding the Managing Your Money Super Bundle. I would be happy to try and help you if you have any questions. I’m only interested in providing you with resources that I believe are going to help you further your education. Please leave a comment here about what you think about the bundle or if you have questions regarding the bundle and I’ll try to help answer them here.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]